Any Questions? Let’s talk

Invoice Factoring Services in Penn Hills Township PA

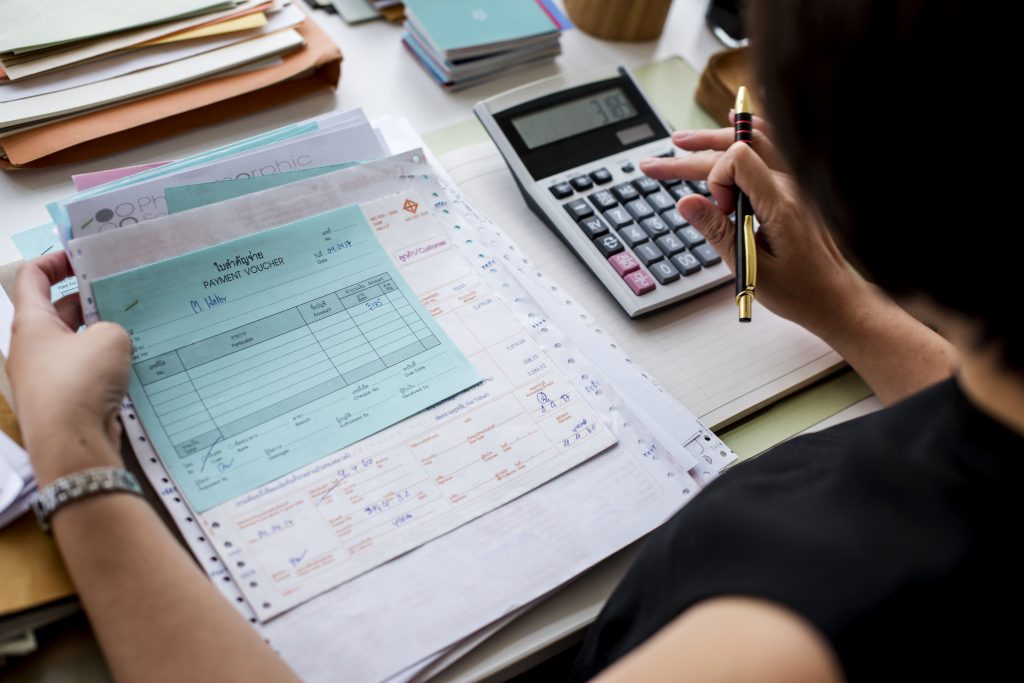

A lot of firms in Penn Hills Township have trouble with customers who don’t pay on time, which can cause cash flow concerns. It could be challenging to manage your business if you have to wait 30, 60, or even 90 days for invoices to go through. We offer invoice factoring services that turn unpaid bills into cash right away, making it easy and quick to get the money you need.

We buy your accounts receivable at a slight discount and send you most of the invoice value within 24 to 48 hours, so you don’t have to wait for slow-paying customers. Once your buyer pays, the rest of the money, minus our fee, is sent to you.

Brighter Horizons LLC offers invoice factoring in Penn Hills Township, PA, by helping local businesses keep their operations running smoothly and plan for what’s next. Invoice factoring lets you deal with seasonal changes or improve your cash flow without losing control of your organization.

How Our Invoice Factoring Helps

- Fast access to cash: Receive most of your invoice value in as little as one business day.

- No loans, no added debt: This is not borrowing—it’s your revenue, made available sooner.

- Keep current on expenses: Pay suppliers, meet payroll, and handle operating costs on time.

- We handle collections: Our team manages customer payments so you can focus on running your business.

- Better cash flow stability: Close the gaps in revenue created by late invoice payments.

We serve a wide range of industries, including logistics, staffing, construction, manufacturing, and services—any business where cash flow depends on timely customer payments.

Local Support, Flexible Cash Flow

We understand how important it is for businesses in Penn Hills Township to have access to consistent funding. Delayed payments shouldn’t stand in the way of meeting daily obligations or growing your business. Our invoice factoring solutions are built around performance, not just credit scores. If your customers have a reliable payment history, we can help you access the funds you’re owed—fast.

Our invoice factoring service in Penn Hills Township, PA, is built for flexibility. Our invoice factoring gives you the operating cash you need to move forward with confidence, whether you’re dealing with slow times, big orders, or planning to grow.

Our process of working:

- Apply online or speak with our team: Get started with a quick online application or by calling us directly.

- Submit your unpaid invoices: Choose which invoices you want to factor—no obligation to factor everything.

- We verify your customers and approve quickly: Our team reviews the credit strength of your clients and responds fast.

- Receive funding within 24–48 hours: Once approved, most of the invoice amount is transferred to your account.

- We collect payment from your consumer: When they pay the bill, we send you the rest of the money, minus our charge.

Our process is designed to keep your business moving forward without delays, long paperwork, or unnecessary stress. We’re here to help, whether you need a one-time fix or continuing help.

Why Choose Us

No New Debt

This is not a loan. You’re using money already earned, so there are no interest charges, monthly payments, or long-term obligations. Just simple access to working capital when you need it.

Flexible Terms

You decide which bills to factor. There are no minimum requirements or locked-in contracts, so you can use factoring when it fits your business—not the other way around.

Local Support

We work with businesses throughout Penn Hills Township and understand the financial landscape here. You won’t be passed around. Our team is hands-on and ready to help.

FAQs

Most clients receive funds within 24 to 48 hours after approval. Once we verify your invoices and customer details, we move fast to make sure your business doesn’t face cash delays.

Yes, factoring typically involves notifying your customers, as they will pay the factor directly. We handle this professionally to maintain the relationship you’ve built with your clients.

No, you’re in control. You can choose which invoices to submit for factoring. Some clients factor weekly, others only during cash flow crunches—it’s entirely based on your needs.